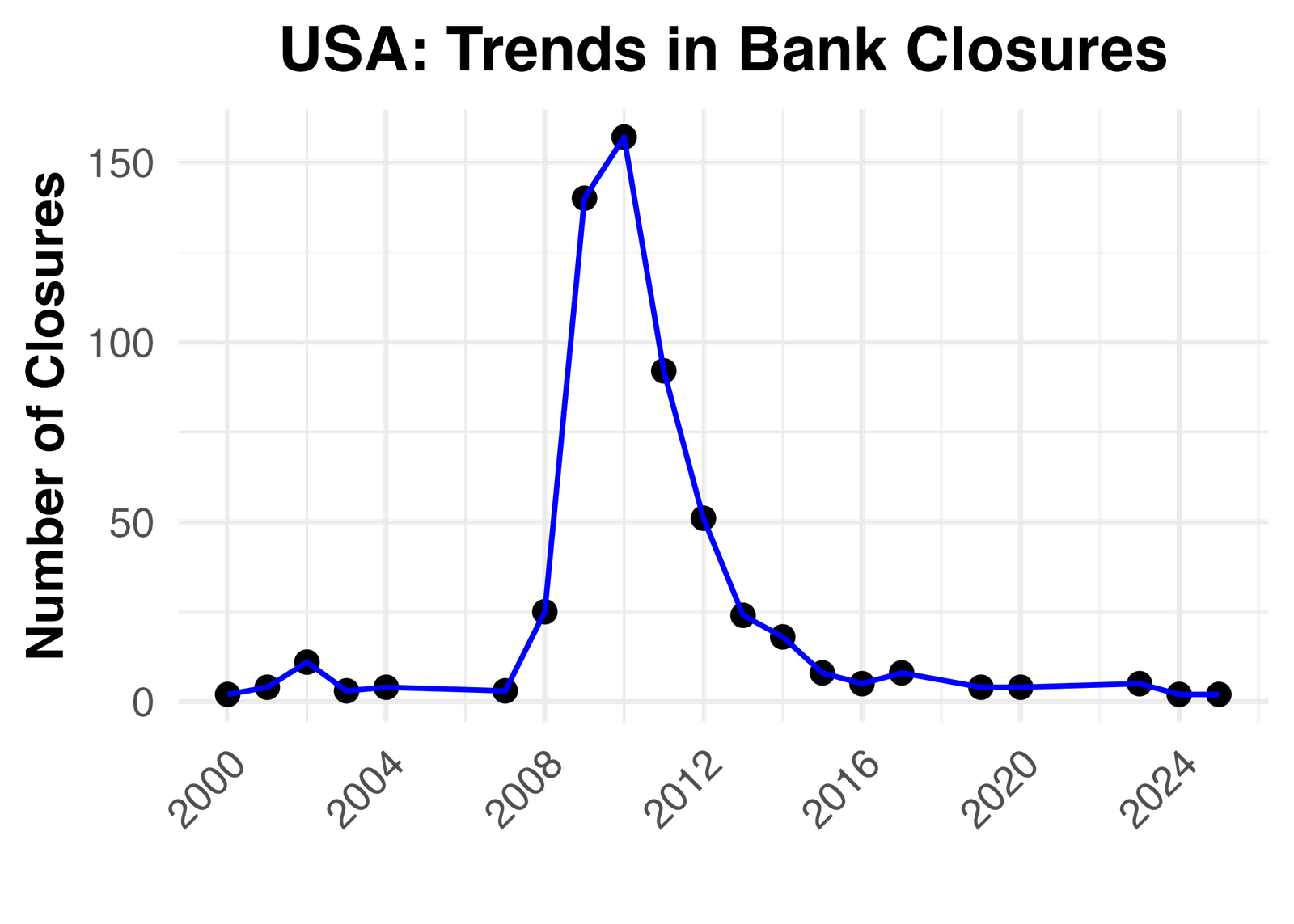

United States: Bank Closures (2000 – 2025)

This post may contain affiliate links. If you use them, we may earn a commission at no extra cost to you. Please see our disclaimer page for more information.

Notice a sharp spike in bank closures during the late 2000s, aligning with the global financial crisis. After that peak, the number of closures steadily declined, indicating a gradual recovery and improved regulatory oversight. From the mid-2010s onward, closures remained low and stable, suggesting a more resilient banking sector. A few closures still occurred sporadically, reflecting isolated cases rather than systemic issues. Overall, the data highlights a clear boom-and-bust pattern followed by long-term stabilization.

Contact our team for more information or a customized report.

Data source: Federal Deposit Insurance Corporation (FDIC)