Last Updated: February 2, 2026

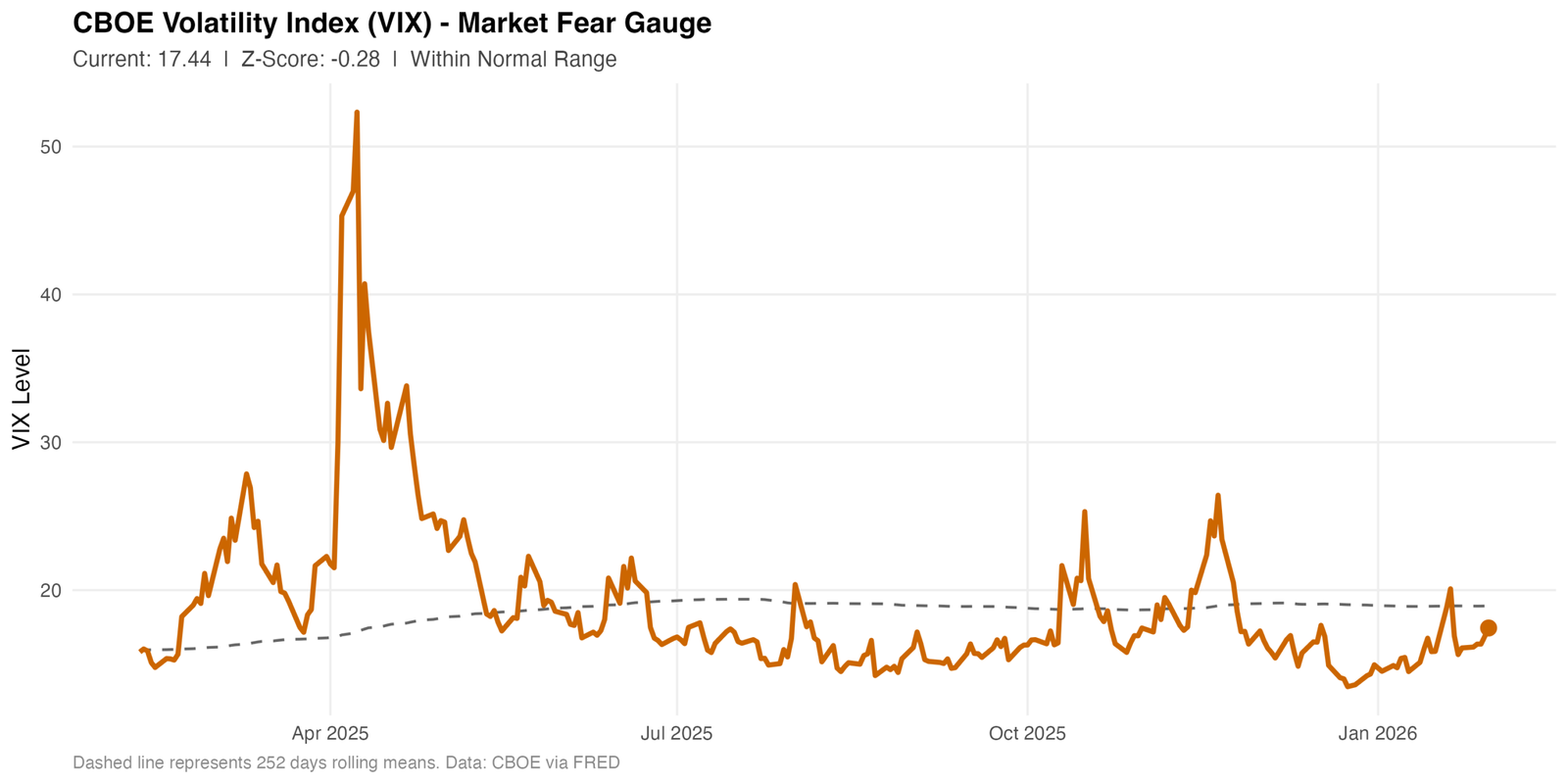

Key Takeaway: As of January 30, 2026 , market volatility is within normal range (17.44) with normal movement. The VIX remains stable based on this indicator.

Overview

This report evaluates market volatility as of January 30, 2026 , using the CBOE Volatility Index (VIX) from FRED. Rolling 252-trading-day statistical benchmarks are applied to both VIX levels and daily changes to distinguish structural volatility trends from short-term market shocks. Z-score analysis is used to identify when current values deviate meaningfully from recent historical patterns.

Daily Analysis

The VIX for January 30, 2026 closed at 17.44. The level Z-score is -0.28 (Within Normal Range, 39th percentile). The delta Z-score is +0.25 (Normal Movement). Day-over-day change: +0.56 points.

Statistical Interpretation: The VIX level is 0.28 standard deviations below its 252-day mean, placing it at the 39th percentile of the recent 252 observations. The indicator remains well within its usual 252-day historical range. Today’s change of +0.25 standard deviations is typical for daily movements. Volatility remains consistent with recent 252-day trends.

Custom Research and Analysis: Need a specialized evaluation or help interpreting specific datasets? We provide professional statistical analysis and custom reporting tailored to your requirements. Contact us to request a custom report.