Last Updated: January 29, 2026

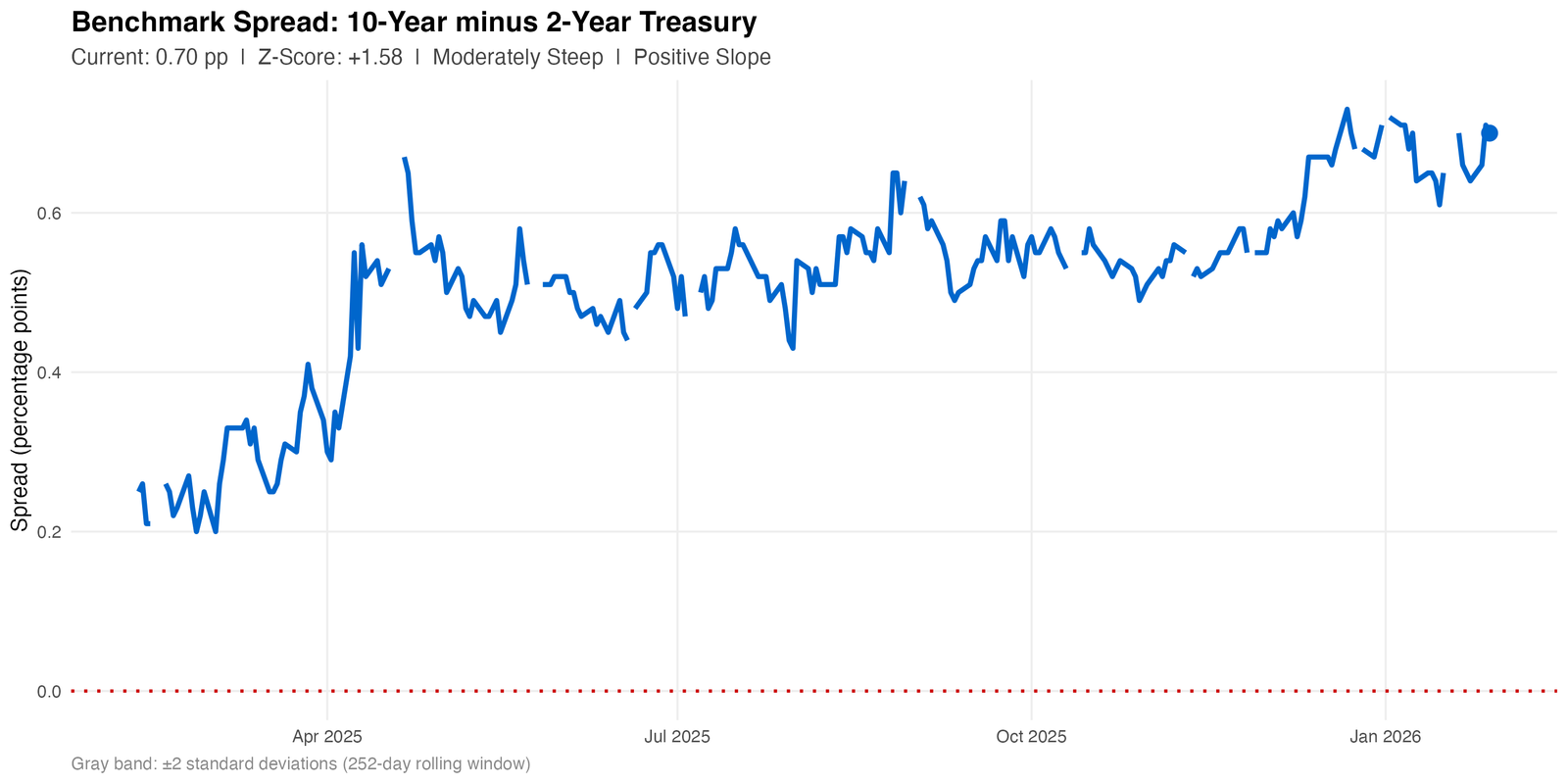

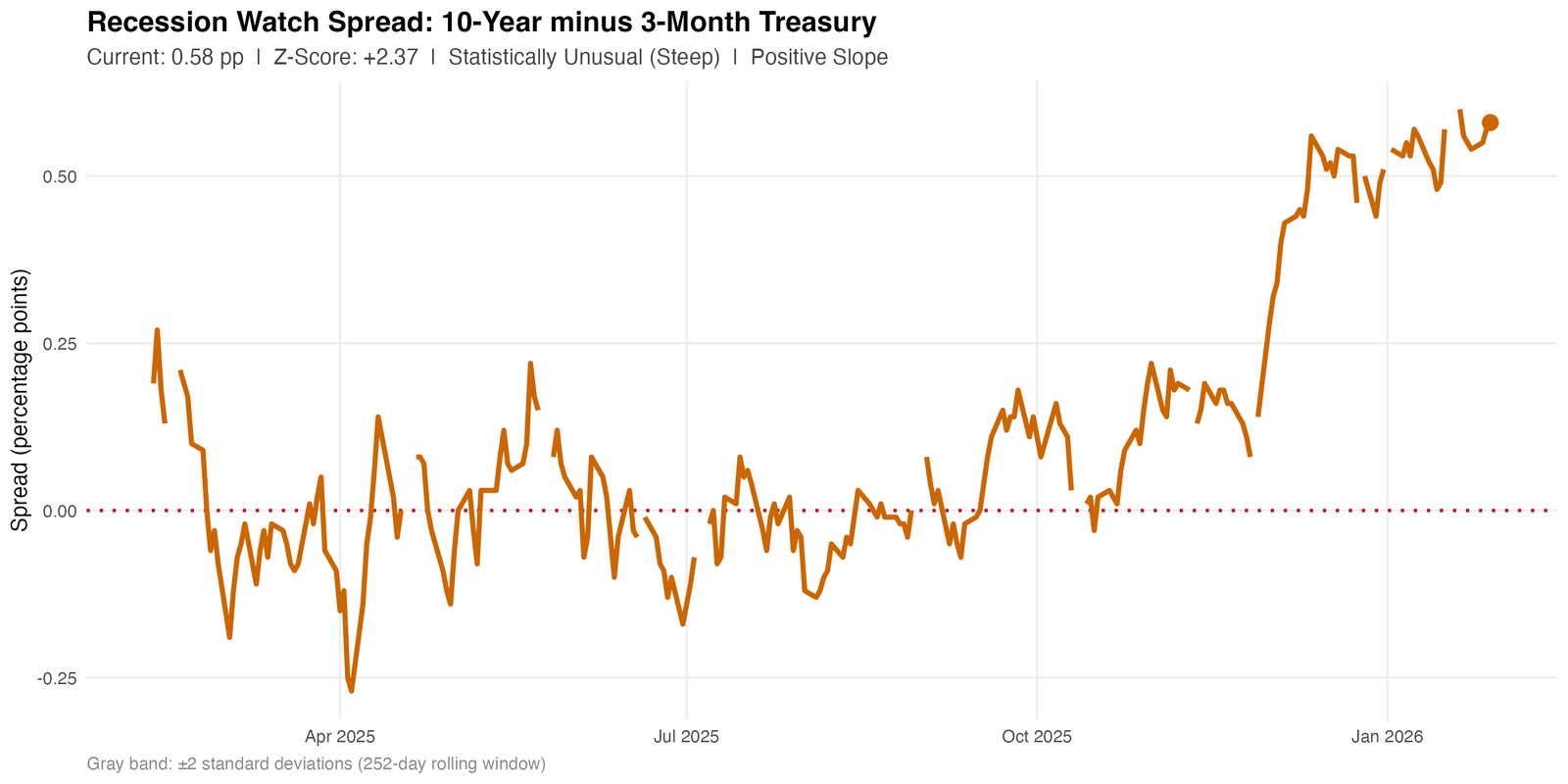

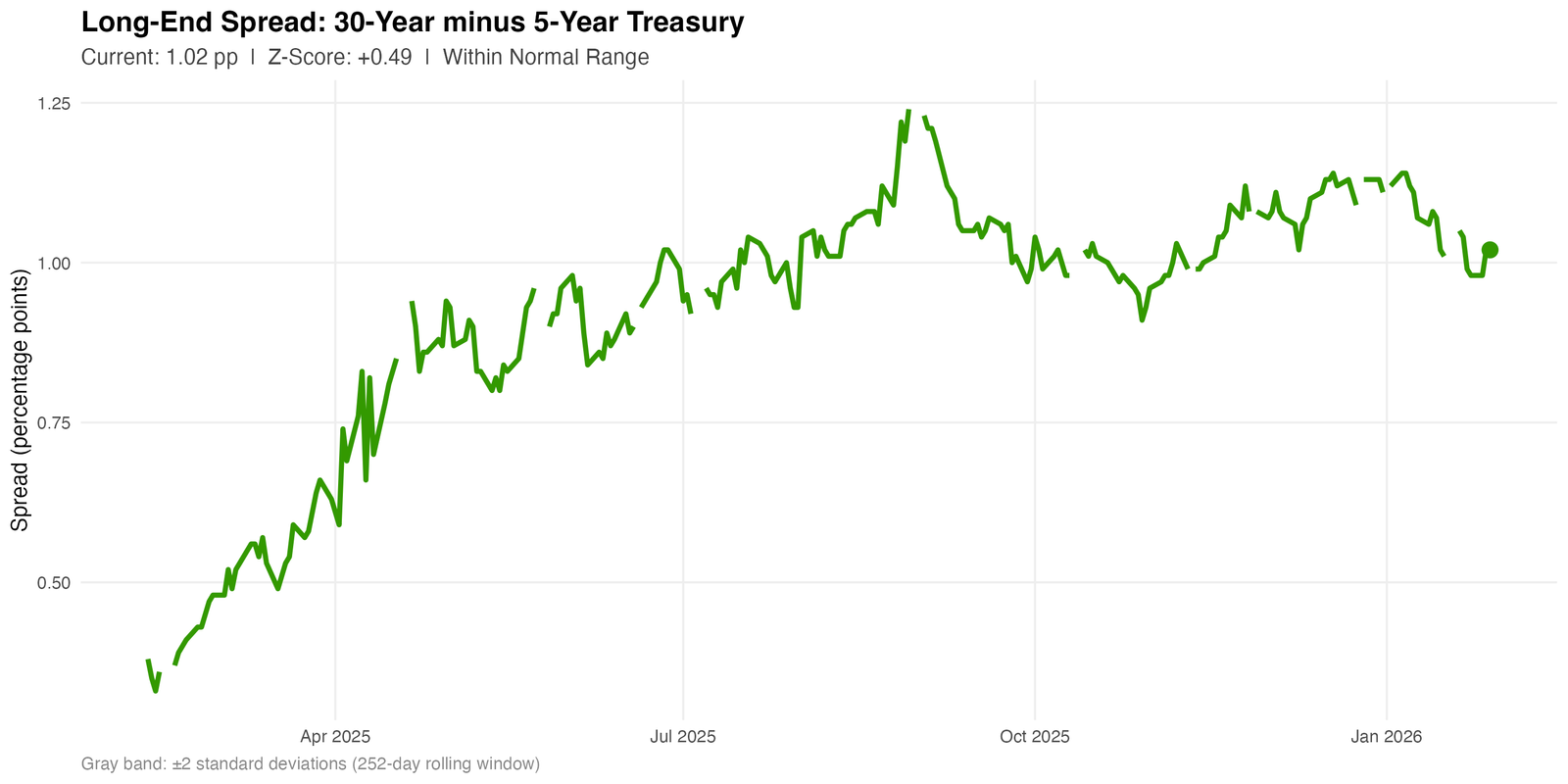

Key Takeaway: As of January 28, 2026, the Benchmark Spread (10y-2y) is moderately steep with normal movement. The Recession Watch (10y-3mo) is statistically unusual (steep) with normal movement. The Long-End Spread (30y-5y) is within normal range with normal movement.

Overview

This report evaluates U.S. Treasury yield curve conditions as of January 28, 2026, using daily closing yields and rolling 252-trading-day statistical benchmarks. Both the level of each spread and its daily change are assessed to distinguish structural positioning from short-term market shocks. Z-score analysis is used to identify when current values deviate meaningfully from recent historical patterns.

BENCHMARK SPREAD (10-Year minus 2-Year)

The current spread is 0.70 percentage points with a Positive Slope curve status. The level Z-score is +1.58 (Moderately Steep, 94.3th percentile). The delta Z-score is -0.34 (Normal Movement).

Statistical Interpretation: The spread is currently 1.58 standard deviations above its 252-day mean, placing it at the 94.3th percentile of recent observations. The series is beginning to diverge from its long-run average, though still within historically common bounds. The curve maintains a positive slope (long rates exceed short rates).

RECESSION WATCH SPREAD (10-Year minus 3-Month)

The current spread is 0.58 percentage points with a Positive Slope curve status. The level Z-score is +2.37 (Statistically Unusual (Steep), 99.1st percentile). The delta Z-score is +0.21 (Normal Movement).

Statistical Interpretation: The spread is currently 2.37 standard deviations above its 252-day mean, placing it at the 99.1st percentile of recent observations. This level has moved beyond normal variation and merits attention. The curve maintains a positive slope (10-year rates exceed 3-month rates).

LONG-END SPREAD (30-Year minus 5-Year)

The current spread is 1.02 percentage points. The level Z-score is +0.49 (Within Normal Range, 68.9th percentile). The delta Z-score is -0.05 (Normal Movement).

Statistical Interpretation: The spread is currently 0.49 standard deviations above its 252-day mean, placing it at the 68.9th percentile of recent observations. The indicator remains well within its usual historical range. The long end remains elevated relative to intermediate maturities.

Custom Research and Analysis: Need a specialized evaluation or help interpreting specific datasets? We provide professional statistical analysis and custom reporting tailored to your requirements. Contact us to request a custom report.